The CCA pre-contractual obligations (including the requirement to provide information in a standard form PCCI document) will be disapplied for the newly-regulated products instead a more flexible regime based on the FCA rules will apply. In practice, this means merchants will be required to obtain approval for promotions of these products from an authorised firm – this could, but does not have to, be their BNPL or STIFC lender partner. Advertising and promotions of BNPL and STIFC agreements will fall within the UK financial promotions regime. The government's view is that there is minimal risk of brokers pushing consumers towards BNPL and STIFC products unsuitable for their needs since, unlike most regulated products, merchants do not receive a commission for brokering BNPL and STIFC agreements, and instead pay a fee to the lender to provide the credit. Merchants offering newly regulated BNPL and STIFC products as a payment option at point of sale will be exempt from FCA regulation as credit brokers. The main aspects of the regulatory regime for the newly in-scope products will include the following areas: The government believes this tailored approach strikes the right balance between consumer protection and a proportionate burden on firms.

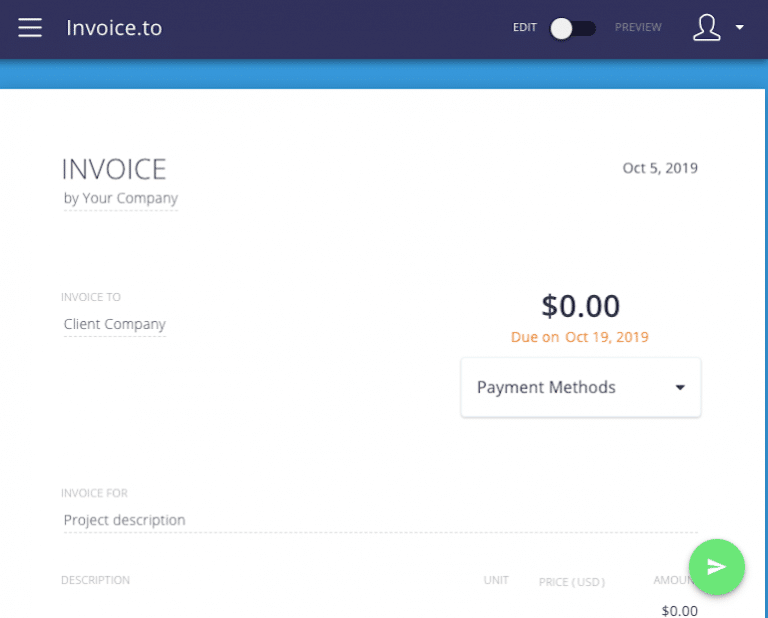

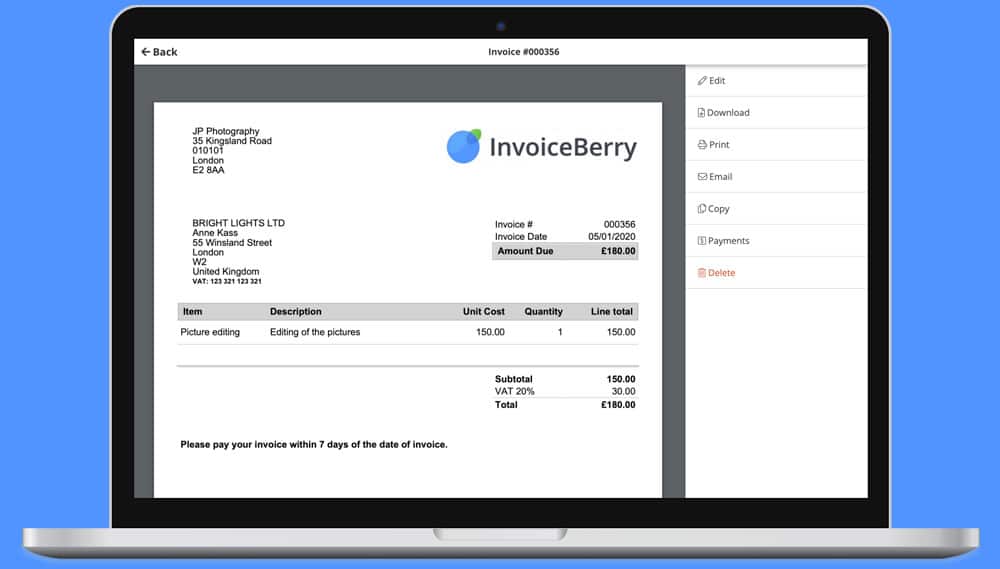

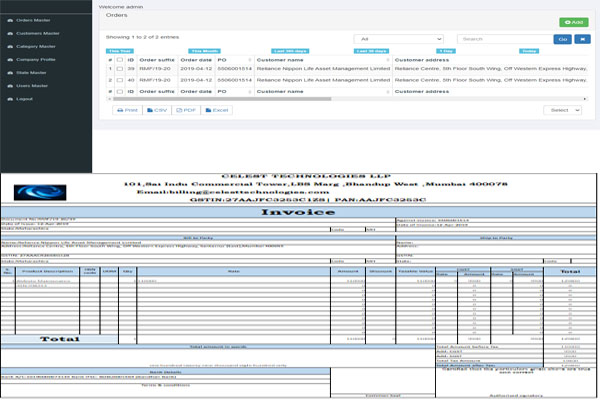

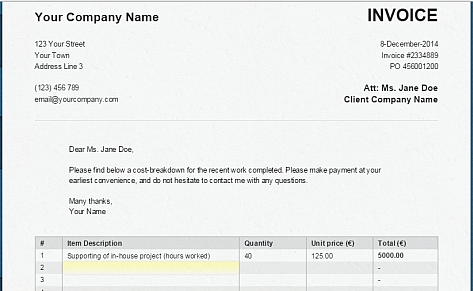

#FCA ONLINE INVOICING FULL#

However, there remain industry concerns about the potential impact of applying the full consumer credit legal and regulatory regime to BNPL and STIFC on competition and innovation.

Many respondents argued strongly against this. Some respondents will see this as HM Treasury deciding to apply a watered-down regime to BNPL lenders even though they directly compete with fully regulated credit card lenders, which gives them an unfair advantage. Shortly before publishing its consultation response, HM Treasury announced that it intends to reform the CCA more broadly.Īrguably, this has softened the landing for HM Treasury's proposals to "tailor the application of" the CCA to BNPL and STIFC. However, others felt that the existing CCA requirements should be applied in full to BNPL with reform coming later, or that the government should undertake broader reform in parallel. Some respondents considered that a tailored approach to BNPL could be a test case for wider reform of CCA requirements. HM Treasury noted that many respondents to its consultation made the case for broader reform of the regulatory controls provided by the CCA that apply to all regulated credit agreements.

Instead, any lender offering either STIFC or BNPL will need to be authorised by the UK Financial Conduct Authority (FCA), and will be required to comply with certain aspects of the regulatory regime, including carrying out affordability checks to ensure loans are affordable for consumers. However, respondents to the consultation pointed out that both types of product are rapidly changing and adapting to changes in consumer behaviour in the market, and that the lines between the two product types are increasingly blurred.ĭrawing STIFC into the regulatory perimeter at the same time as BNPL means that the government will not have to draw what it now realises is a tricky distinction between the two. The credit may also be used to finance subscriptions such as gym memberships or to purchase season tickets. STIFC: typically offered in-store, with the consumer taking out a one-off, higher-value agreement with the credit provider, who may be a third-party lender or the merchant.BNPL: credit usually taken out online with the consumer having an overarching relationship with a third-party lender, under which multiple low-value agreements are made with little transactional friction as a result.

While exempt BNPL products and STIFC products rely on the same exemption under article 60F(2) of the Financial Services and Markets Act 2000 (Regulated Activities) Order 2001 (RAO), the government drew a distinction between them in its initial consultation and suggested that BNPL should be regulated while STIFC should not. The regulatory perimeter will be extended to capture not only currently exempt interest-free buy-now-pay-later (BNPL) products but also currently exempt short-term interest-free credit (STIFC) products that are provided by third-party lenders. HM Treasury has also set out, in its consultation response (20 June 2022), more specific plans to bring exempt interest-free lending within the scope of regulation, following a much-anticipated consultation. The government has announced (16 June 2022) that it intends to reform the Consumer Credit Act 1974 (CCA), with the long-awaited project expected to take place over an extended timeframe and more details on its approach anticipated later in the year.

0 kommentar(er)

0 kommentar(er)